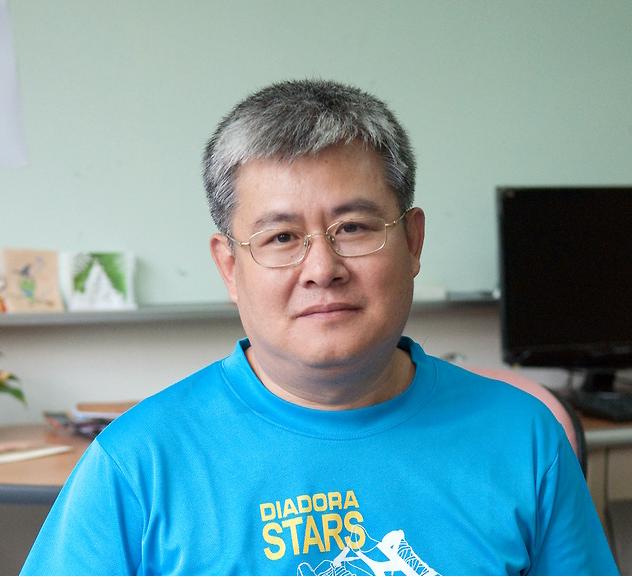

Yuan-Chung Sheu ( 中文版 )

Professor of Applied Mathematics

Contact information

Email : sheu@math.nctu.edu.tw Tel : +886-3-571-2121 ext. 56428 Fax : +886-3-572-4679 Address : Department of Applied mathematics, National Yang Ming Chiao Tung University, Hsinchu, Taiwan 30050.

Teaching

- 114學年度第一學期:

- Calculus (I)

- Probability Theory (I)

- 114學年度第二學期:

- Calculus (II)

- Probability Theory (II)

Vitae

- Education

- Ph.D. in Mathematics, Cornell University, 1993.

- Research Areas

- Probability Theory and its Applications.

- Positions, Honors and Awards

- Associate Professor of Mathematics, NCTU, 1993~1998

- Professor of Mathematics, NCTU, 1999~

- General Member, MSRI at Berkeley, 1997~1998

- Chair, Mathematics Department, NCTU, 2001~2003

- Associate Editor, Taiwanese Journal of Mathematics, 2004~2013

- Visiting Scholar, University of Washington, Seattle, USA, 2006~2007

- Associate Dean, College of Science, NCTU, 2005~2006, 2007~2008

- Vice President, Taiwanese Mathematical Society, 2012~2013

- Editor, Advances and Applications in Statistics, 2012~2021

Publications/Preprints

- Probabilistic Analysis for Scalogram Ridges in Signal Processing (jointly with Gi-Ren Liu and Hau-Tieng Wu), Quarterly of Applied Mathematics, Accepted, 2026

- On random fields associated with analytic wavelet transform (jointly with Gi-Ren Liu and Hau-Tieng Wu), IEEE Transactions on Information Theory, VOL. 72, NO. 3, MARCH 2026

- Gaussian Approximation for the Moving Averaged Modulus Wavelet Transform and its Variants (jointly with Gi-Ren Liu and Hau-Tieng Wu), Applied and Computational Harmonic Analysis, Vol.74, January 2025

- Model-based assessment of photoplethysmogram signal quality in real-life environments (jointly with Yan-Wei Su, Chia-Cheng Hao, Gi-Ren Liu and Hau-Tieng Wu) 2024 32nd European Signal Processing Conference (EUSIPCO), 1726-1730, 2024

- Ridge detection for nonstationary multicomponent signals with time-varying wave-shape functions and its applications (jointly with Yan-Wei Su, Gi-Ren Liu and Hau-Tieng Wu), IEEE Transactions on Signal Processing, Vol.72, 4843-4854, 2024

- Reconsider photoplethysmogram signal quality assessment in the free living environment (jointly with Yan-Wei Su, Chia-Cheng Hao, Gi-Ren Liu and Hau-Tieng Wu), Physiological Measurement 45(6),06NT01(2024), Link

- When Scattering Transform Meets Non-Gaussian Random Processes, a Scaling Limit Result(jointly with Gi-Ren Liu and Hau-Tieng Wu), Bernoulli 30(3): 2346-2371 (August 2024)

- Matrix Deviation Inequality for lp-Norm (jointly with Te-Chun Wang), Random Matrices:Theory and Applications Vol. 12, No. 4 (2023) Link

- Central and Non-central Limit Theorems arising from the Scattering Transform and its Neural Activation Generalization (jointly with Gi-Ren Liu and Hau-Tieng Wu) SIAM Journal on Mathematical Analysis 55 (2) 1170-1213 (2023) Link (Early version, 53 pages)

- Asymptotic Analysis of Higher-order Scattering Transform of Gaussian Processes (jointly with Gi-Ren Liu and Hau-Tieng Wu) Electronic Journal of Probability, Vol. 27, paper no. 48, 1-27 (2022) Link

- Large scale assesment of consistency in sleep stage scoring rules among multiple sleep centers using an interpretable machine learning algorithm (jointly with Gi-Ren Liu, Yu-Lun Lo, Hau-Tieng Wu and et al.) Journal of Clinical Sleep Medicine, Vol. 17, No 2 (2021), 159-166

- Save muscle information - unfiltered EEG signal helps distinguish sleep stages (jointly with C. Lustenberger, Y. L. Lo, W. T. Liu and H. T. Wu) Sensors 20 (2020).

- Explore intrinsic geometry of sleep dynamics and predict sleep stage by unsupervised learning techniques (jointly with Gi-Ren Liu, Yu-Lun Lo, Hau-Tieng Wu), Book chapter, Harmonic Analysis and Applications, Springer, 2021, 279-324.

- Diffuse to fuse EEG spectra -- intrinsic geometry of sleep dynamics for classification (jointly with Gi-Ren Liu, Yu-Lun Lo, John Malik, Hau-tieng Wu), Biomedical Signal Processing and Control, 55 (2020), 101576.

- The L2-Cutoff for reversible Markov Chain (jointly with Guan-Yu Chen and Jui-Ming Hsu). Annals of Applied Probability, 27, 2304-2341 (2017).

- First exit from an open set for a matrix-valued Lévy process (jointly with Yu-Ting Chen and Yu-Tzu Chen), Statistics and Probability Letters, 127, 104-110 (2017).

- Pricing perpetual American compound options under a matrix-expoenetial jump-diffusion model (jointly with Ming-Chi Chang and Ming-Yao Tsai), Applied Mathematical Finance, 22 (2015), 553-575.

- Disorder chaos in the spherical mean-field model (jointly with Wei-Kuo Chen, Hsin-Wei Hsieh and Chi-Ruey Huaung), Journal of Statistical Physics (2015), 160; 417-729.

- Free boundary problems and perpetual American strangles (jointly with Ming-Chi Chang), Quantitative Finance 13(2013), No.08, 1149-1155.

- A note on Gerber-Shiu function for hyper-exponential jump-diffusion processes (jointly with Yu-Ting Chen and Ming-Chi Chang), Elect. Comm. in Probab.18 (2013), No.2, 1-8

- The cutoff phenomenon for Ehrenfest chains (jointly with Guan-Yu Chen and Yang-Jen Fang). Stochastic Processes and Their Applications 122 (2012), 2830-2853.

- On optimal stopping problems for matrix-exponential Lévy processes(jointly with Ming-Yao Tsai). Journal of Applied Probability, 49,531-548(2012).

- On the discounted penalty at ruin in a jump-diffusion model, Taiwanese Journal of Mathematics, 14, 1337-1350(2010)(jointly with Yu-Ting Chen)

- A Generalized Model for Optimum Future Hedge. Handbbok of Quantitative Finance and Accounting, Lee,Cheng-Few, Lee, John(Eds.), Springer, 873-852(2010).(jointly with Jang-Yi Lee, Kehluh Wang, and Cheng-Few Lee)

- A note on r-balayages of matrix-exponetial Lévy processes, Elect. Comm. in Probab. 14(2009), 165-175 (jointly with Yu-Ting Chen)

- A generalized renewal equation for two-sided jump-diffusion models, Stochastic Analysis and Applications, 27,897-910 (2009) (jointly with Yu-Ting Chen)

- An integral equation approach for defaultable bond prices with applications to credit spreads, J. Appl. Prob. 46, 71-84 (2009). (jointly with Yu-Ting Chen and Cheng-Few Lee)

- The least cost super replicating portfolio in the Boyle-Vorst discrete-time option pricing model with transaction costs. International Journal of Theoretical and Applied Finance, Vol. 11, No.1, 55-85(2008).(jointly with Guan-Yu Chen and Ken Palmer)

- An ODE approach for the expected discounted penalty at ruin in a jump-diffusion model, Finance and Stochastics, 11, 323-355 (2007). (jointly with Yu-Ting Chen and Cheng-Few Lee)

- The least cost super replication portfolio for short puts and calls in Boyle-Vorst option pricing model with transition cost, Advances in Quantitative Analysis and Accounting, 5, 1-22 (2007) .(jointly with Guan-Yu Chen and Ken Palmer)

- On the Log-Sobolev Constant for the Simple Random Walk on the n-cycle: The Even Cases, Journal of Functional Analysis, 202, 473-485 (2003).

- A Hausdorff measure classification of polar lateral boundary sets for superdiffusions, Mathematical Proceedings of Cambridge Philosophical Society, 128, 549-560 (2000).

- On a problem of Dynkin, Proceedings of the AMS, 127, 3721-3728 (1999).

- Life time and compactness of range for super-Brownian motion with a general branching mechanism, Stochastic Processes and their Applications, 70, 129-141 (1997).

- On states of exit measures for superdiffusions, Ann. Probab., 24, 268-279 (1996).

- On positive solutions of some nonlinear differential equation-a probablistic approach, Stochastic Processes and their Applications, 59, 43-53 (1995)

- Removable boundary singularities of solutions of some nonlinear differential equations, Duke Math., 74, 701-711 (1994)

- Asymptotic behaviour of superprocesses, Stochastics and Stochastics Reports, Vol. 49, 239-252 (1994).

- A Hausdroff measure classification of G-Polar sets for the superdiffusions, Probab. Theory Relat.Fields, 95, 521-533 (1993).

Update. 02/11/2026